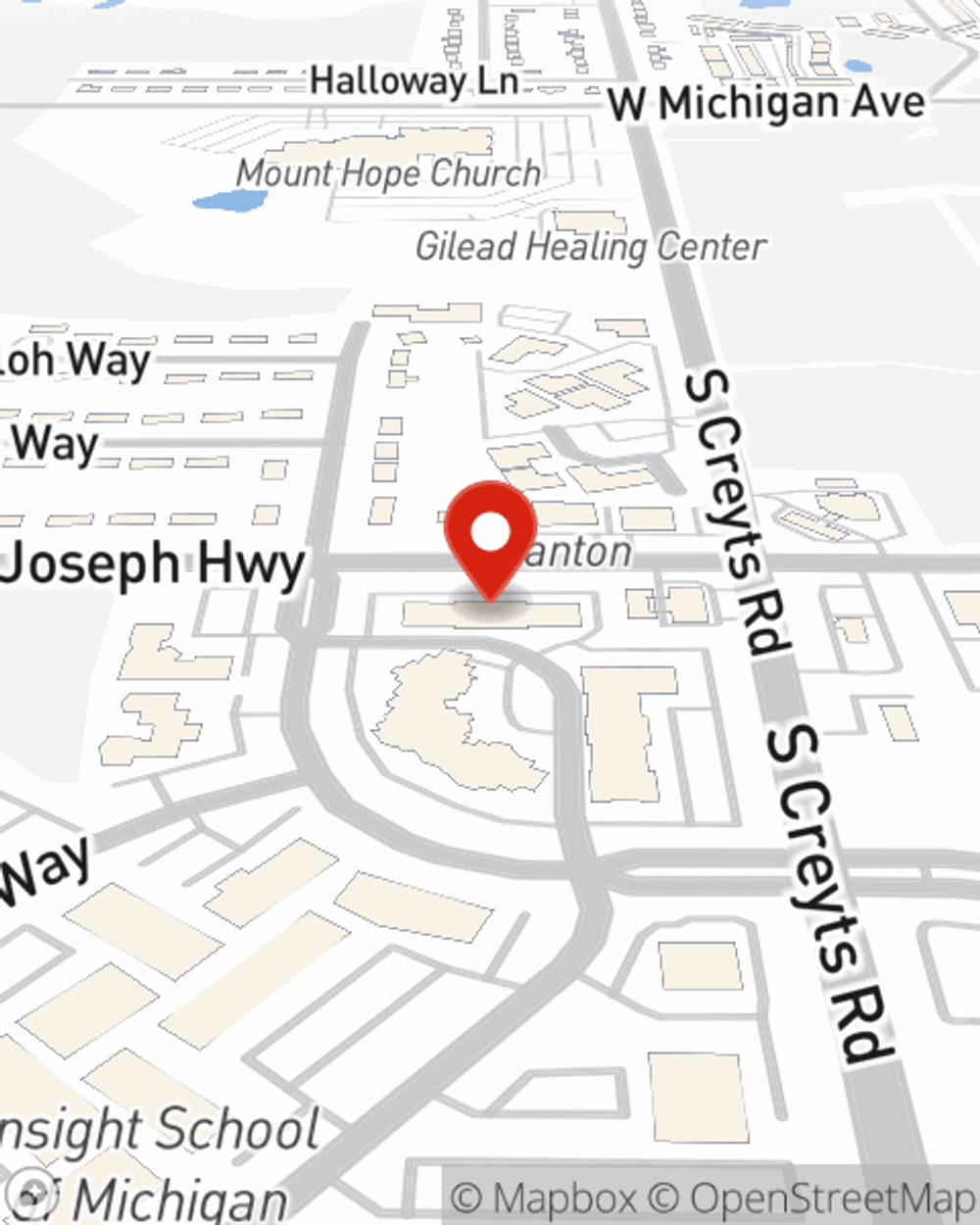

Renters Insurance in and around Lansing

Welcome, home & apartment renters of Lansing!

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented house or space, renters insurance can be the right decision to protect your personal items, including your hiking shoes, TV, children's toys, silverware, and more.

Welcome, home & apartment renters of Lansing!

Your belongings say p-lease and thank you to renters insurance

Protect Your Home Sweet Rental Home

Renting a home makes the most sense for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance might cover damage to the structure of your rented home, but that doesn't cover the things you own. Renters insurance helps shield your personal possessions in case of the unexpected.

There's no better time than the present! Reach out to Jennifer Blumer's office today to talk about the advantages of choosing State Farm.

Have More Questions About Renters Insurance?

Call Jennifer at (517) 372-0200 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Jennifer Blumer

State Farm® Insurance AgentSimple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.