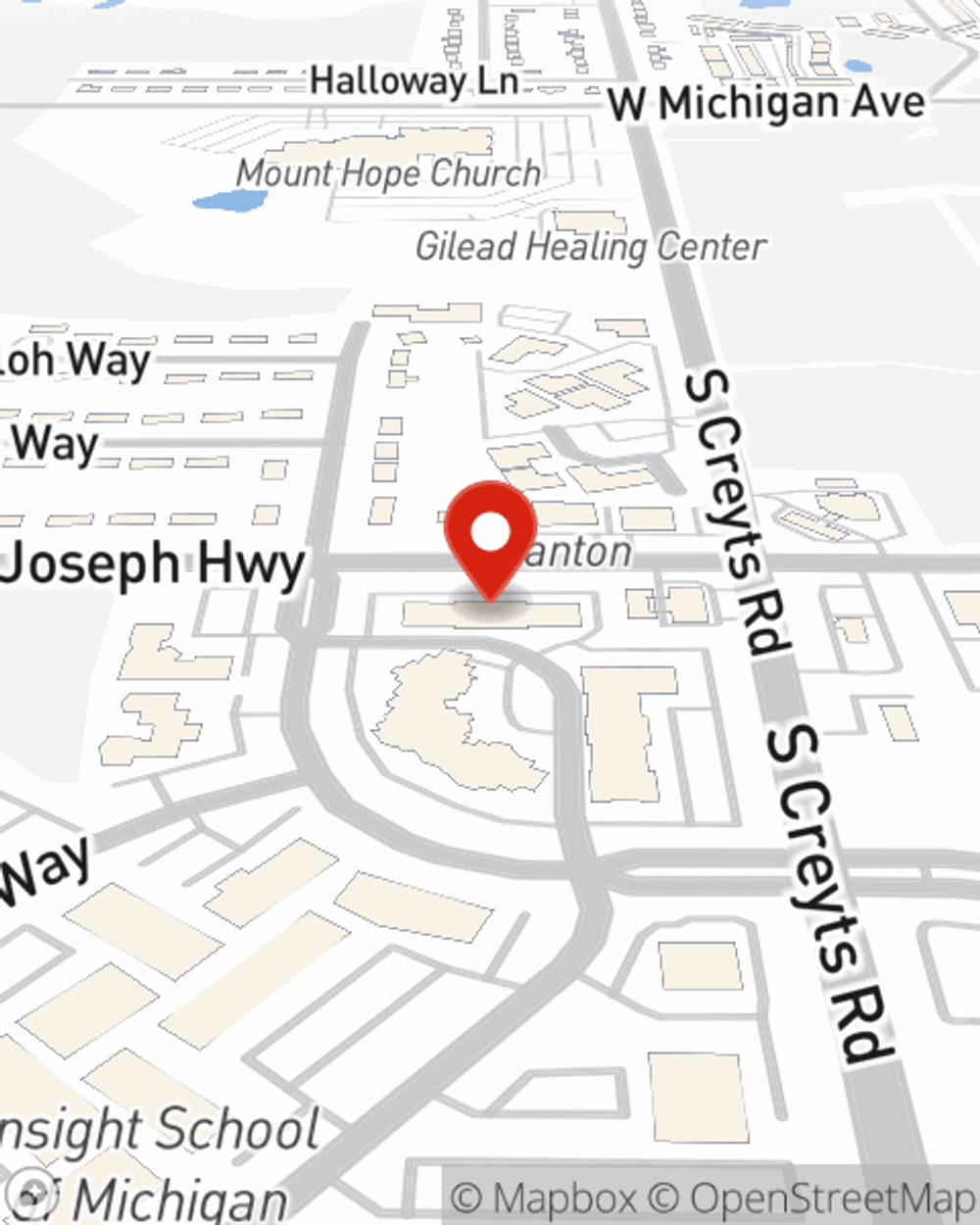

Business Insurance in and around Lansing

Calling all small business owners of Lansing!

Almost 100 years of helping small businesses

State Farm Understands Small Businesses.

Small business owners like you have a lot on your plate. From customer service rep to financial whiz, you do whatever is needed each day to make your business a success. Are you a psychologist, a dog groomer or an HVAC contractor? Do you own a bagel shop, a craft store or a beauty salon? Whatever you do, State Farm may have small business insurance to cover it.

Calling all small business owners of Lansing!

Almost 100 years of helping small businesses

Get Down To Business With State Farm

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for commercial liability umbrella policies, builders risk insurance or artisan and service contractors.

As a small business owner as well, agent Jennifer Blumer understands that there is a lot on your plate. Call or email Jennifer Blumer today to discuss your options.

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Jennifer Blumer

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.